VCs Who (Not Really) Help Out in Fundraising

As a VC, one of my many roles is to help introduce teams in which we have invested to a small highly-curated list of other strategic and VC investors for future financings.

As a VC, one of my many roles is to help introduce teams in which we have invested to a small highly-curated list of other strategic and VC investors for future financings.

As we wind down the year and people go their separate ways to celebrate the holidays, ask yourself this: does your entire team meet often to discuss mission, vision and goals? If not, this should be a New Year’s resolution high on the list.

We spend a lot of time at Promus Ventures getting to know the founders and their background. We talk a lot about Founder-Market fit, the how and why of each person working at a startup.

Alongside our friends Hoxton Ventures, we are privileged to co-lead the Series A for Behavox, a London-based company that is building the next generation compliance surveillance platform for banks, hedge funds, traders, brokers and other financial institutions utilizing NLP, voice analytics and advanced neural networks.

We’re finally seeing real teams build real robotic products that are solving massive pain points in numerous different industries. Robotic startup funding (ex-Drones) increased from $273M in 2014 to $587M in 2015, with $1.4B in cumulative funding since 2011 (CB Insights, 3/23/16). We’ve watched many robotic teams building product over the last several years but are NOW truly starting to see real value propositions within both consumer and enterprise.

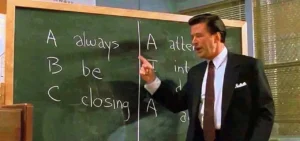

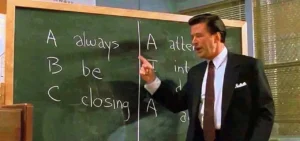

It is rare to see founding teams, even the good ones, continually scheduling meetings with potential future investors when the team isn’t currently raising a round. It is counterintuitive and frankly hard to do.

With the recent volatility in the market, we expect the conversion of convertible notes in a tighter Series A market environment to get a little more interesting. Not that the conversion road hasn’t been littered with lurid tales already…

As we write this, the Nasdaq is off 14.5% YTD, with the S&P down 9.3% YTD. And it’s just the beginning of February. Only the ostriches with their heads in the sand fail to recognize that the investing winds have indeed shifted.

Somewhere in VC Investor Due Diligence 101, an investor is supposed to ask startup founders who would be good acquirers of their business if everything goes well. You see, most VCs invest their limited partners’ capital out of a pooled fund, and these limited partners expect said VCs to return their capital to them with a 3x cash-on-cash return. These VCs raise funds that are 10 years stated in length with a 3–4 year investing period for their platform companies on the front end and investing in winning follow-ons for the remainder of the fund.

We recently received an update report from a startup team in the Promus Ventures community. The deck was full of bad news: delays for certain product components were increasing, more bugs and unstable builds than usual, longer than anticipated QA testing, certain new hires were not working out, and a list of a myriad of other issues the team was facing.

No posts were found for provided query parameters.