As a VC, one of my many roles is to help introduce teams in which we have invested to a small, highly curated list of other strategic and VC investors for future financings.

If not careful, a VC who sets off to make introductions can fail the founding team in the manner in which they connect the company to other investors (and many times the founders have no idea). Recently, I received a couple of intros from other VCs that, although certainly wasn’t their intention, quickly decreased our desire to learn more.

Listen, I’m not talking about the cold, crazy incoming deal emails that provide comic relief in the middle of the day. I’ve recently received separate startup emails claiming “the most socially beneficial venture in history,” “the best and only!” and “this company is the future!” (Well then, sign me up). No, I am talking about emails from bonafide VCs whose delightful prose turned out to be a contrarian indicator of how we evaluated the company.

If you’re part of a startup, I hope your investors have never done these things when connecting new investors to your company:

- Not put the receiving investor’s name at the top. Just nothing.

- Put some pithy general statement like, “I’m excited to show you this round and finally get something in front of you.” That should work for a long list of recipients…

- Hurl superlatives about the team but never mention any high-level numbers on the business at all.

- Fail to mention if they are going to participate in the next round — “we will probably invest again.” Probably? Serious conviction.

- Ask if you would like to lead the round. Somewhat like asking if you want to get married to someone you’ve never met.

- Have different font sizes throughout the email, cutting and pasting certain parts of the email to efficiently send out to the masses. Amazing how the cut and paste never seems to format correctly…

- Have incorrect words in sentences changed by that editing nemesis Mr. Spellcheck, revealing the author’s breakneck writing speed and refusal to go back and read over the text even once.

- Randomly hear from other VCs wondering if you received the email. This means the other VC got the same harried email and also spideysensed that the sending vc mailchimped it to 30 other investors as well.

- Try to tailor some umbrella industry thesis to fit an investor’s strategy, such as “know you like deals that have great leverage and can scale quickly.” Right, because other investors don’t like those models…

- Try to close with a personal touch but include someone else’s name. Whoops.

- Send two separate emails from different investors in the same company reaching out. It’s easy to see this team hasn’t controlled the process and instead released the hounds. (I add this because I once had some investors reply to my intro stating that they had already been contacted about the round, which makes the company look desperate and unorganized. I also add this point so I can say this list goes to 11.)

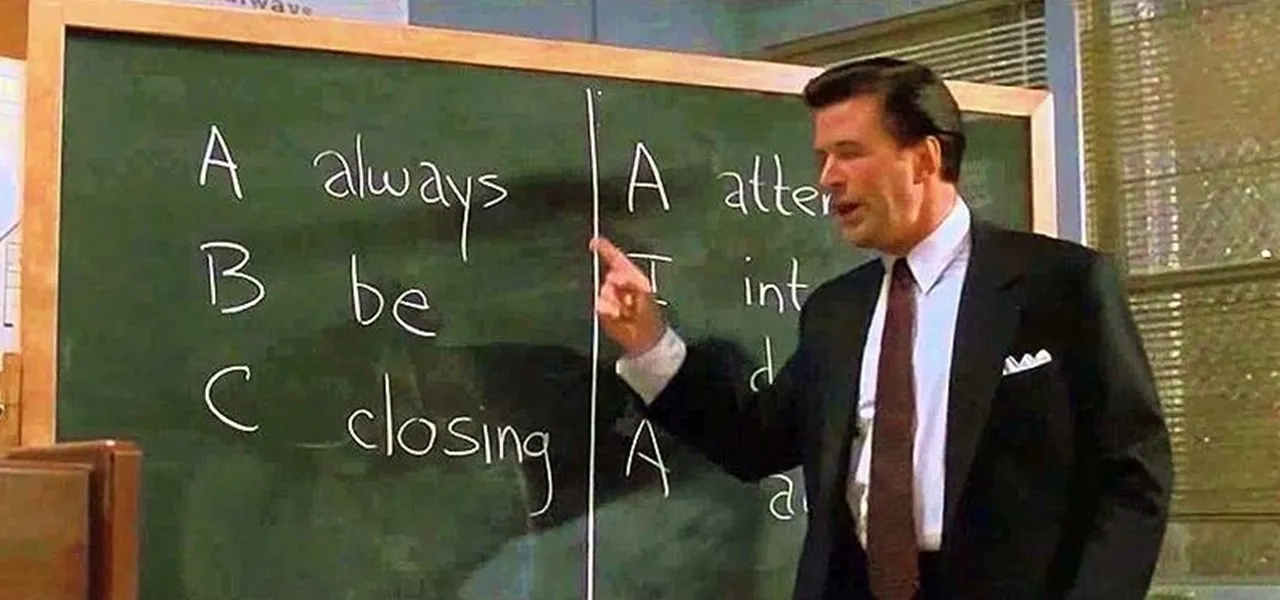

Introducing new investors should be short and sweet. Start the introduction process well in advance of fundraising. Get the investor’s verbiage out of the way and have the founders briefly describe the business. Have the team include data points that show customers, growth and KPIs that show clearly the team is making progress. Organize the intro so that the investor is just giving a prospective investor a short window into a talented team.

Do your homework when curating the new investor list and only connect to investors that have similar companies/business models in which they have invested. I recently had an email from an investor saying they know how much we like to invest in our hometown of New York (pssst, Promus Ventures is in Chicago).

And lastly, only let investors that are investing in the next round (or have a good reason as to why they are not investing) introduce new investors to the startup. One of the best indications of the strength of a team is how many current investors want to invest in the new round. Amazing how that works…

Recipients of this post are not to construe it as investment, legal, or tax advice, and it is not intended to provide the basis for any evaluation of an investment in any fund. Prospective investors should consult with their own legal, investment, tax, accounting, and other advisors to determine the potential benefits, burdens, and risks associated with making an investment in any fund.