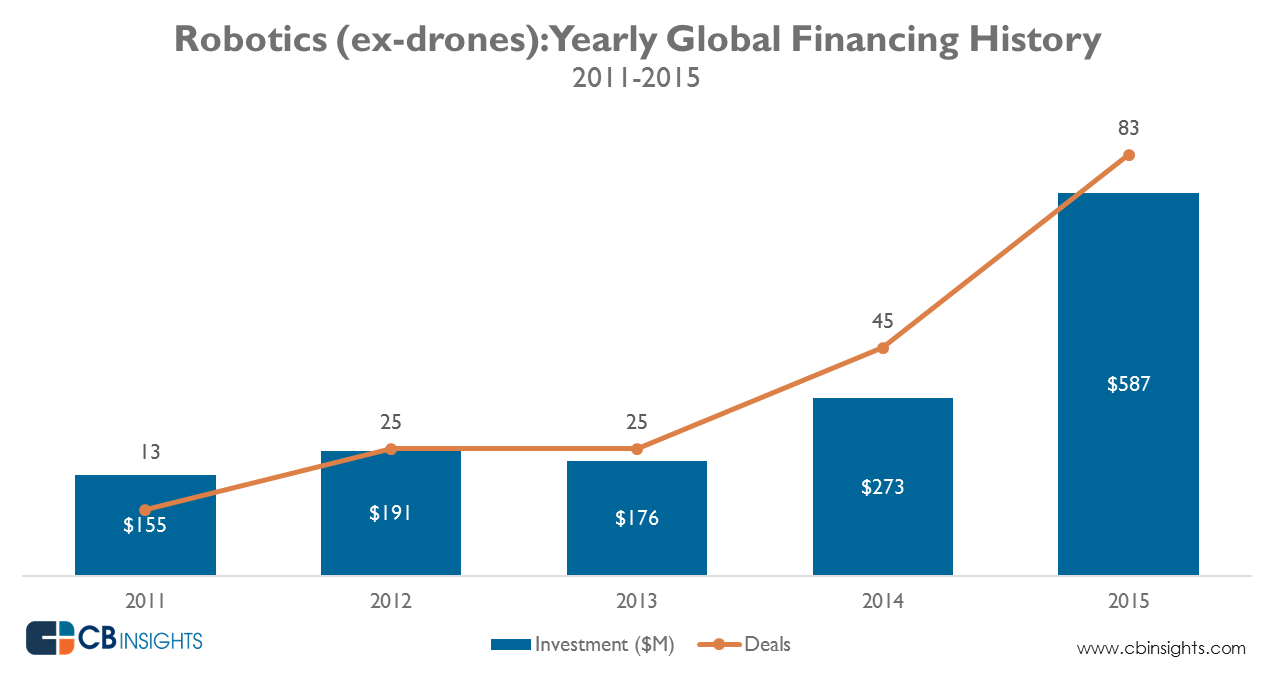

We’re finally seeing real teams build real robotic products that are solving massive pain points in numerous different industries. Robotic startup funding (ex-Drones) increased from $273M in 2014 to $587M in 2015, with $1.4B in cumulative funding since 2011 (CB Insights, 3/23/16). We’ve watched many robotic teams building product over the last several years but are NOW truly starting to see real value propositions within both consumer and enterprise.

At Promus Ventures, we are software investors who work a lot with hardware teams. We believe hardware is merely a wedge into many hard-to-reach areas where software by itself cannot go alone. We have been privileged to invest in and sit on the boards of many terrific hardware companies and teams: Spire, Navdy, Airware, Whoop, Gauss Surgical, Swift Navigation, Bellabeat, and June to name a few. Hardware is still hard (hence the name), but we are as bullish as ever on investing in these teams and businesses.

Numerous developments to the robotic BoM are pushing robotics quickly to the consumer forefront. The absolute cost of manufacturing robots has decreased significantly, as off-the-shelf hardware and software have given teams the ability to create a full-stack solution that can be delivered much cheaper than ever before. The cost of core sensors to these builds has been declining precipitously, and other key components are also getting more efficient and cheaper. Combined with scaled manufacturing and more effective use cases for consumer-focused machines, robots are finding their way into more and more areas where the unit economics and product-market fit finally make sense.

Robots are no different than any of these hardware theses, just a different set of team skills and backgrounds. Every disruptive business eliminates noise in a variety of ways, and autonomous robots are now truly poised to take out excess labor noise in interesting ways. We see a long line of vertically industry-specific robotic teams solving issues in areas where the TAMs/SAMs are enormous by themselves.

Many of these robotic teams are staying rather quiet, currently conducting PoCs and pilots with consumer- and enterprise-facing companies. GM’s recent acquisition of Cruise has (fortunately or unfortunately) seemingly has lit the vc community on fire, as many are suddenly salivating to invest in robotic teams. As always, nothing has changed until one day everything changes.

We’re giddy to be working with the robotic teams in which we have invested and we look forward to helping many more build global businesses in the years to come. Release the robots!

Recipients of this post are not to construe it as investment, legal, or tax advice, and it is not intended to provide the basis for any evaluation of an investment in any fund. Prospective investors should consult with their own legal, investment, tax, accounting, and other advisors to determine the potential benefits, burdens, and risks associated with making an investment in any fund.