Every startup is a unique microcosm. Investors who think they can pattern match every new portfolio company are mistaken. Founders who believe they can insert an old formula that worked in a previously successful company they ran or were involved with may run into trouble.

For founders and teams, there are measured risks (competition, market size, product) as well as idiosyncratic risks (gov’t, geopolitical, other) that have to be navigated. It’s hard — really hard — to continue talking with customers only to hear “we like what you’re doing and we’ll be back to you” time and time again. Sometimes it’s more refreshing to hear “no” immediately than this constant drip of indecision. It’s hard — really hard — to keep tweaking and testing a product only to find new issues after the update. Harder still to throw away hundreds of hours of coding a product even if it is the right thing to do.

In the same vein, conclusions that angels and vcs draw from one company do not necessarily correlate with others. Introducing one team to various corporate relationships may work well for them but lead to hours of wasted time for another. Connecting companies to experienced talent that interviewed well at one company may be a waste of another team’s time. What is seen as good advice drawing from years of working with a company may be woefully inane to another similar team. The only constant is change, and things can change in a hurry.

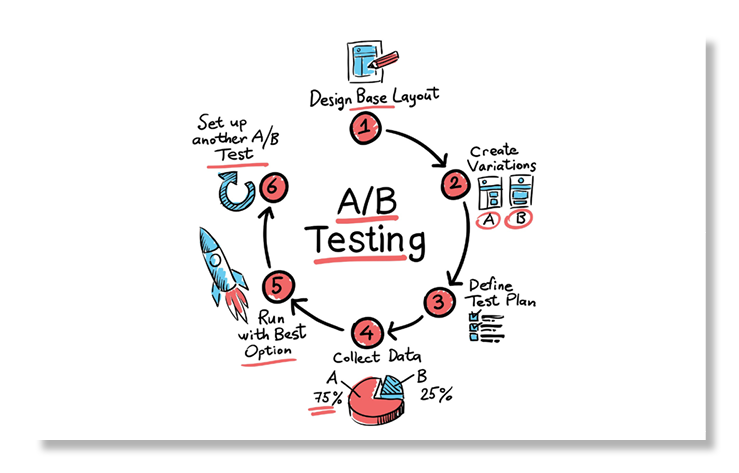

The net for founders and investors? Life is a constant A/B test. Learn quickly, tack confidently, and move on. Stay tenacious, keep moving the bar higher, focus on the task at hand. Admit there are many things you don’t know and will only know by suiting up day after day after day. Stop trying to answer everything, and start questioning more.

The key to consistently getting up early in the morning is to have something to get up for. If what drives you is the glitter of a founder or investor title, those who keep slogging through and learning while they go will end up the victors. And the worst thing is that you’ll never even realize that you’ve always been stuck in the mud.

Recipients of this post are not to construe it as investment, legal, or tax advice, and it is not intended to provide the basis for any evaluation of an investment in any fund. Prospective investors should consult with their own legal, investment, tax, accounting, and other advisors to determine the potential benefits, burdens, and risks associated with making an investment in any fund.