People. Product. Potential.

Investing in early stage companies is hard. Firm criteria for making good investments shouldn’t be. Every investor has a different flavor of how he or she invests. We like to keep it simple at Promus Ventures and focus on basic blocking and tackling.

Accelerators: Release the Hounds!

I am hard pressed to find one reason why this staggering growth is a bad thing. The world is rapidly building these fantastic mini-ecosystems that serve as on-ramps to the Startupalooza Highway.

Burn Baby Burn

Too Much Too Soon = Disco Inferno. Early enterprise adoption success shouldn’t always translate to massive additional funding.

Picked the Wrong Investors for Your Startup? You Probably Forgot to Do This

Just as investors fire a long list of questions at startup teams (do they ever stop asking questions), founders can and should do the same with doting investors.

Serious Questions Every Startup Should Ask Now

I believe every startup should dream big, be tenacious, iterate always, and change the world. But whether in plenty or in want, RIGHT NOW every startup on planet earth should take their entire core team to the mirror and ask themselves these questions:

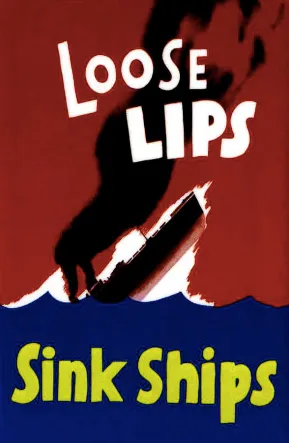

Loose Lips Sink Ships

I recently sat on a plane coming back from SFO and was forced to listen (for three hours plus) to a vc and startup founder in back of me loudly wax poetic about a wide range of opinions about other VCs and startups. These people should have known better, and knowing some of these companies and investors, some o

Stacking Building Blocks (The Software Way)

In computer science jargon, the “software stack” is software that sits on top of a system’s core kernel (or operating system). The stack gives a feature set to the operating system, expands it function and makes it sing. The more layers a developer adds to the stack, the more enriching the experience and

Equity is Not Candy

Equity can get doled out in early days like candy thrown from a parade to anyone and everyone because that’s the only currency that founders can afford to pay. We see the following situations occur more than we like...

Wait, What Do You Do? (Your Startup Value Prop Better Be Simple)

Put simply, one’s “value proposition” is the reason why your product works. When an enterprise or consumer initially encounters your product, their immediate reaction will tell you if you have something that is special or just another interesting idea.

Founders Are Not Deals To Be Done

The venture capital vernacular has been around for decades. Round sizes morph (“old” versus “new” Series A) and new classes emerge (“super angels” and “micro-VCs”) but I continue to hear some investors talk like this...