Raise One Round Ahead

It is rare to see founding teams, even the good ones, continually scheduling meetings with potential future investors when the team isn’t currently raising a round. It is counterintuitive and frankly hard to do.

Convertible Note Pricing Could Get Uglier

With the recent volatility in the market, we expect the conversion of convertible notes in a tighter Series A market environment to get a little more interesting. Not that the conversion road hasn’t been littered with lurid tales already…

Ramifications of Tech Downturn for VC/Startups (Excerpts from Our Latest LP Letter)

As we write this, the Nasdaq is off 14.5% YTD, with the S&P down 9.3% YTD. And it’s just the beginning of February. Only the ostriches with their heads in the sand fail to recognize that the investing winds have indeed shifted.

Build To Never Be Acquired (Don’t Listen to the VCs)

Somewhere in VC Investor Due Diligence 101, an investor is supposed to ask startup founders who would be good acquirers of their business if everything goes well. You see, most VCs invest their limited partners’ capital out of a pooled fund, and these limited partners expect said VCs to return their capital t

Bad News is Good News (Building Great Founder/Investor Relationships)

We recently received an update report from a startup team in the Promus Ventures community. The deck was full of bad news: delays for certain product components were increasing, more bugs and unstable builds than usual, longer than anticipated QA testing, certain new hires were not working out, and a list of a

Make Them Earn It

Top founders know a secret when it comes to hiring and fundraising: give prospective employees and investors homework and make them earn it.

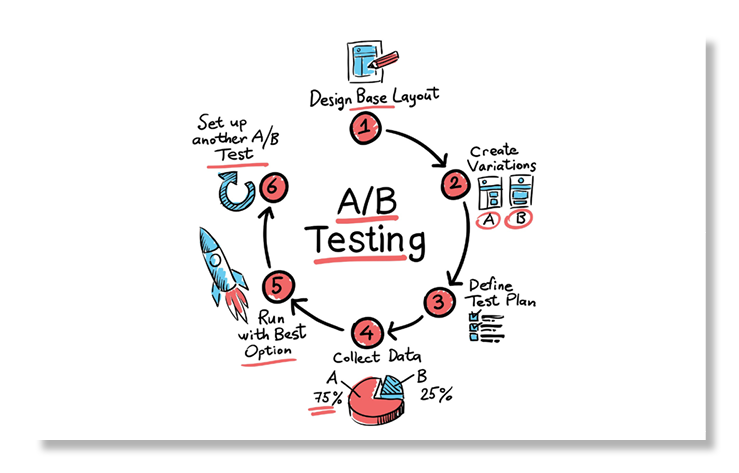

Life is a constant A/B test

Every startup is a unique microcosm. Investors who think they can pattern match every new portfolio company are mistaken. Founders who believe they can insert an old formula that worked in a previously successful company they ran or were involved with may run into trouble.

People. Product. Potential.

Investing in early stage companies is hard. Firm criteria for making good investments shouldn’t be. Every investor has a different flavor of how he or she invests. We like to keep it simple at Promus Ventures and focus on basic blocking and tackling.

Accelerators: Release the Hounds!

I am hard pressed to find one reason why this staggering growth is a bad thing. The world is rapidly building these fantastic mini-ecosystems that serve as on-ramps to the Startupalooza Highway.

Burn Baby Burn

Too Much Too Soon = Disco Inferno. Early enterprise adoption success shouldn’t always translate to massive additional funding.