Written by Pierre Festal

2 min read

January 20, 2021

For those who haven’t been paying attention to the latest developments on Wall Street (and you will be forgiven given the number of crazy things going on in all corners of the world), 2020 was the year of the Special Purpose Acquisition Company (“SPAC”).

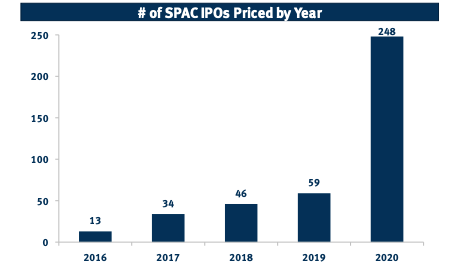

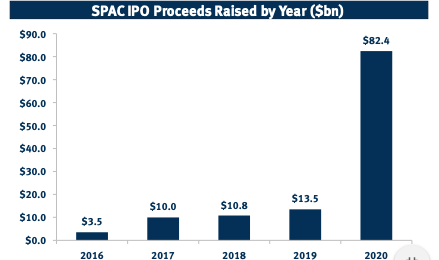

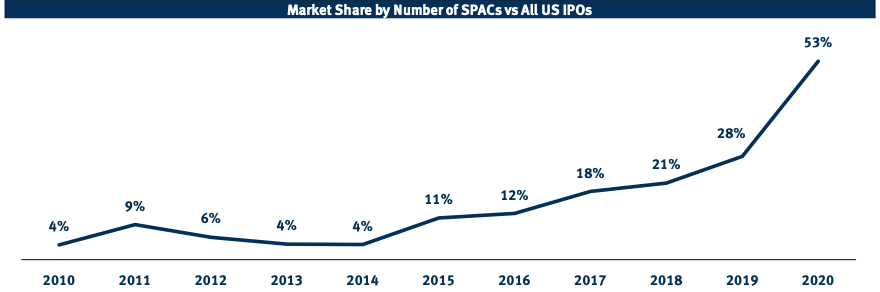

A once-obscure, not so respectable nor respected instrument has become the fastest growing method of financing in the public and private markets. 248 SPAC IPOs raising $82.4Bn were priced in 2020 according to Dealogic, more than 4x the number of deals in the whole of 2019 and nearly 20x that of 2016. In total SPAC IPOs accounted for 53% of all IPOs in 2020.

SPACs are shell companies that raise money through an IPO on a regulated exchange with the sole purpose of identifying and executing a merger with an existing private company.

SPACs have been around since the early ’90s and were often promoted by people with questionable backgrounds and expertise and usually seen as the last chance saloon for low-quality private companies to go public and raise money. This has changed dramatically over the last few years: SPACs are now more often than not promoted by reputable financial services firms (large PE, VC, Hedge Funds…) and managed by seasoned teams with domain expertise. As a result, their reputation has improved, and so has their ability to attract good quality targets. At the same time, fast-growing companies have been able to stay private longer due to the abundant liquidity in private markets and the pain and cost involved in a traditional IPO process. These factors have created a fertile ground for these fast-growing companies to consider doing a deal with a SPAC.

Despite abundant liquidity in private markets, Deeptech companies continue to struggle to attract capital as they scale. This is all the more true for companies that have built a product in the lab, piloted it in the field, and are starting to receive commercial orders. They need large and increasing amounts of capital to move to volume production and deliver orders and while they have largely de-risked their technology and product-market fit they struggle to raise capital at good valuations as they remain pre-revenue and as such too risky for most investors.

SPACs seem like a good financial solution for this problem as they allow exposure to these promising yet early bets on emerging sectors. Unlike traditional IPOs that focus on past financial performance and future earnings visibility and stability, SPACs are allowed to market on the back of future projections for companies that have little financial history but are on the cusp of fast commercial and operational scaling. This enables investors to assess the future prospects of a business and ask themselves ‘what could be’ as opposed to ‘what has been and what will be’. This difference in approach is well suited to companies marketing breakthrough innovations and on the verge of scaling.

We are seeing a number of good-quality Deeptech companies going the SPAC route. These companies exhibit the characteristics highlighted above and given their tech maturity are able to manage scaling risks. We’re also seeing much more speculative ventures (particularly in the EV space) with little to no track record of executing beyond developing early-stage technology and prototypes without any proof as to their ability to scale manufacturing and commercial delivery. These companies have set themselves a very high bar underpinned by aggressive scaling plans in order to justify high valuations and large capital raises.

As the SPAC market continues to mature it is important for the managers and shareholders of potential target companies to consider the following when deciding to go the SPAC route:

Even though the market looks frothy, 2021 is already shaping to be once again a record year for SPACs with a number of IPOs announced in the first few weeks of the year. There is no question that there will be high-profile failures that will negatively impact investors' returns and perceptions. Looking beyond the current exuberance, SPACs ability to bridge the funding gap between product development and market adoption for fast-growing companies is definitely something we at Promus Ventures are excited about.

Copyright 2021 Promus Ventures, all rights reserved.

Recipients of this post are not to construe it as investment, legal, or tax advice, and it is not intended to provide the basis for any evaluation of an investment in any fund. Prospective investors should consult with their own legal, investment, tax, accounting, and other advisors to determine the potential benefits, burdens, and risks associated with making an investment in any fund.

Promus Ventures is a trademark of Promus Holdings, LLC. Used under license.

Promus Ventures

Offices

Promus Ventures is a trademark of Promus Holdings, LLC. Used under license. All other trademarks are the property of their respective owners.