Written by Mike Collett

2 min read

January 9, 2017

As a vc, one of my many roles is to help introduce teams in which we have invested to a small highly-curated list of other strategic and vc investors for future financings.

If not careful, a vc who sets off to make introductions can fail the founding team in the manner in which they connect the company to other investors (and many times the founders have no idea). Recently, I received a couple intros from other vcs that, although certainly wasn’t their intention, quickly decreased our desire to learn more.

Listen, I’m not talking about the cold, crazy incoming deal emails that provide comic relief in the middle of the day. I’ve recently received separate startup emails claiming “the most socially beneficial venture in history,” “the best and only!” and “this company is the future!” (Well then, sign me up). No, I am talking about emails from bonafide vcs whose delightful prose turned out to be a contrarian indicator in how we evaluated the company.

If you’re part of a startup, I hope your investors have never done these things when connecting new investors to your company:

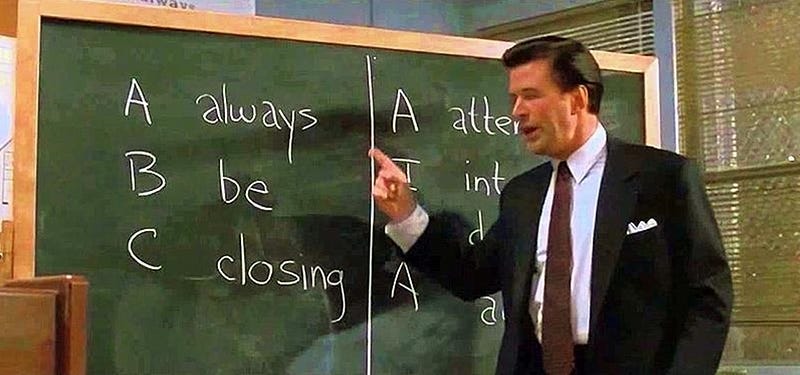

Introducing new investors should be short and sweet. Start the introduction process well in advance of fundraising. Get the investor’s verbiage out of the way and have the founders briefly describe the business. Have the team include data points that show customers, growth and KPIs that show clearly the team is making progress. Organize the intro so that the investor is just giving a prospective investor a short window into a talented team.

Do your homework when curating the new investor list and only connect to investors that have similar companies/business models in which they have invested. I recently had an email from an investor saying they know how much we like to invest in our hometown of New York (pssst, Promus Ventures is in Chicago).

And lastly, only let investors that are investing in the next round (or have a good reason as to why they are not investing) introduce new investors to the startup. One of the best indications of the strength of a team is how many current investors want to invest in the new round. Amazing how that works…

Promus Ventures

Offices

Promus Ventures is a trademark of Promus Holdings, LLC. Used under license. All other trademarks are the property of their respective owners.